Canada’s

big banks

have posted a strong year on the stock market so far this year, but investors need to look across the Atlantic to find the real stars of the financial sector, says one adviser.

“The true outperformance story belongs to European financials, which have led the pack on the back of a rising rate environment and restructuring efforts,” Craig Basinger, chief market strategist at Purpose Investments Inc., said in a note.

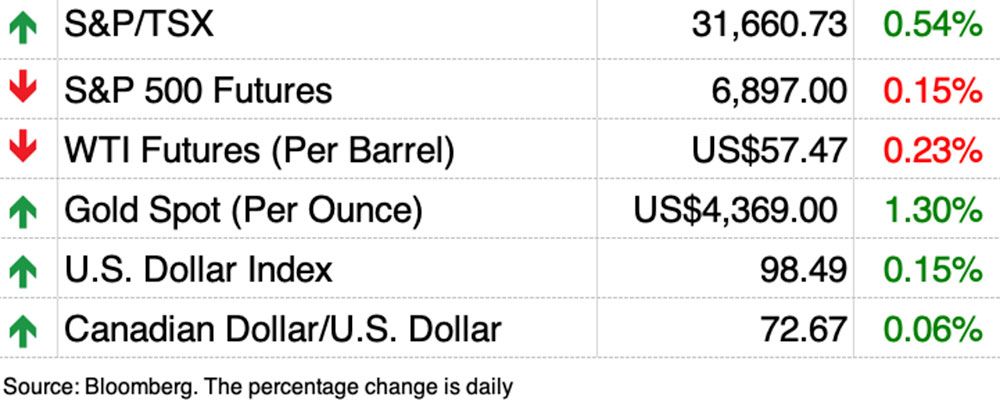

Canadian banks are up approximately 40 per cent on the

S&P/TSX composite index

in 2025, but those gains pale against the 90 per cent gain by their European counterparts and the 60 per cent gain by bank stocks in the United Kingdom. Financials in the United States are only up 23 per cent on concerns about regional banks and commercial real estate worries.

There are a few keys to the European banks’ success on the markets this year, including a shifting interest rate environment.

“The (European Central Bank)’s bias is increasingly shifting toward a neutral-hawkish stance,” Derek Holt, vice-president of Scotiabank Economics, said in a note.

That central bank has held

interest rates

three times since June and policymakers are expected next week to hike the outlook for the eurozone’s economy.

Major restructuring financing, especially in Germany, is expected to boost the region’s economy, with the industrial giant poised to unleash 52 billion euros’ worth of military purchases next week, according to a Bloomberg story.

Macro factors aside, shares of

Canada’s Big Six banks

don’t present a good deal for Basinger.

“What’s clear is that despite growth challenges around the globe, valuations do matter,” he said. “The low valuation starting points for international banks presented significantly higher upside potential.”

That leaves Basinger worried about where the Big Six go from here since they are trading at price-to-earnings ratios that have moved off their long-term average, leaving them “historically expensive.”

He said Canada’s banks are also trading at a 20 per cent premium to their global banking peer average. Yields for the banks are also getting “increasingly skinny,” he said, highlighting Royal Bank of Canada’s yield, which is currently 2.85 per cent, the lowest since 2007.

By comparison, the yield on Canada’s 10-year bonds is 3.4 per cent.

“Canada is typically at a premium, but at current levels, Canadian banks are trading richer than American peers,” he said.

Still, other analysts like the prospects for the Big Six.

“The large Canadian banks put up another stronger-than-expected set of results in the fourth quarter, pushing forward expectations modestly higher coming out of earnings season,” Mike Rizvanovic, an analyst at Scotia Capital Markets, said in a note.

He and other analysts have hiked price targets for all Big Six banks.

But Basinger thinks the overseas banks offer a better opportunity.

“Simply put, the risk/reward proposition for Canadian banks is less attractive on a relative valuation basis,” he said.

Sign up here to get Posthaste delivered straight to your inbox.

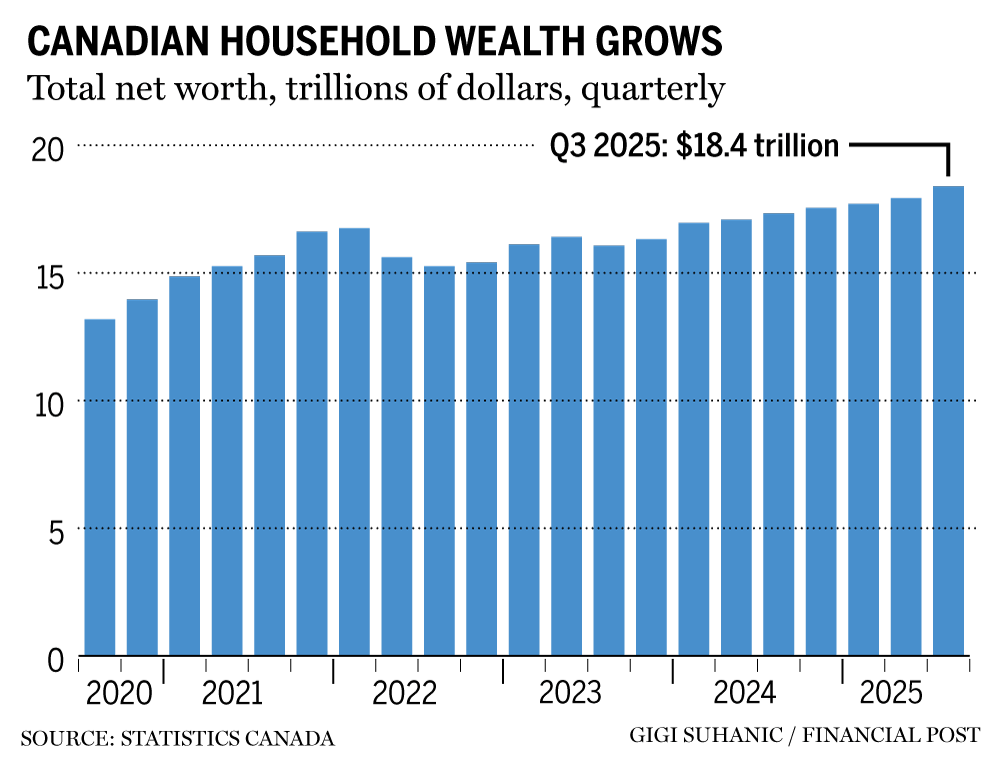

Canadian households increased their total wealth to another record high of $18.4 trillion in the third quarter of 2025, marking a two-year streak where net worth increased for eight consecutive quarters.

Household net worth swelled by 2.6 per cent (or $460.5 billion) since the second quarter of the year, the largest increase in collective household wealth since the first quarter of 2024, according to Statistics Canada’s latest national balance sheet, released Thursday. — Serah Louis, Financial Post

Read the full story here.

- Federal Transport Minister Steven MacKinnon will make an announcement about the next steps for a high-speed rail line.

- Today’s data: Statistics Canada releases wholesale sales excluding petroleum and building permits for October and capacity utilization for the third quarter

- Canada’s oilpatch aims to hold spending steady as global producers brace for tough year

- Who is Mark Wiseman? The career of the man expected to be Canada’s new U.S. ambassador

- Economy has Canadians exploring cheaper cars as stock leans to luxury

To encourage taxpayers to report all of our income, Canada’s

Income Tax Act

imposes penalties for failure to do so. Under the Act, if you fail to report at least $500 of income in a tax year, and in any of the three preceding taxation years, you can be hit with a “repeated failure to report income” federal penalty. Tax expert Jamie Golombek fills us in on what happened to one taxpayer after she failed to report income twice in three years. Keep reading

here

.

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

,

#Posthaste #Canadian #investors #love #Big #banks #good #adviser

0 Comments